Class of Business Training

Record keeping of Class-of-Business Training

Examination bodies marking first level REs are also responsible for recording the results. Before the examination bodies issue results to candidates, the examination bodies upload the results onto the FSCA database, after which the FSCA reconciles them. This process ensures that the FSCA has an accurate and updated database for monitoring and tracking purposes. Under the proposed requirements, second-level REs would fall away, meaning that examination bodies will no longer have the responsibility of record-keeping as it relates to second level REs only.

With the class of business and product-specific training FSPs, KIs and representatives are responsible for providing confirmation of training – provided both internally and externally. The FSP must record all the participants of any class of business or product-specific training in the FSP’s competence register within 15 days after the participants completed the training. The FSP does not need to report this to the FSCA, but the FSP is required to retain all the information and documentation for at least five years or for any other purposes as specified by the Registrar. When the FSCA’s FAIS supervision team conducts site visits as part of their compliance monitoring, the competence register will form part of the monitoring process. The FSP will be required to provide evidence that the training is verified and took place. The FSP is also responsible for providing information from this competency register to the FSCA or product suppliers when requested to do so.[1]

{article Intro-Class-of-business}{text}{/article}

At present, some industry players keep a record of the competency requirements that are currently implemented, i.e. experience, qualifications and first-level REs. Going forward, we suspect the need to update these systems to track class of business and product-specific training. This involves costs to the FSPs to update the capacity of their IT systems and modify the system to consider the extra criteria. Empowering staff that work with compliance to understand the new legislation would also add costs to the industry.

Across the industry, stakeholder consultation showed that some FSPs are equipped to track training activities relatively easily, using more basic methods of tracking competency that differ by business unit. The higher costs of compliance will thus fall on the latter group who will need to dedicate time and additional resources to upscaling their current systems, ensuring interoperability and upskilling staff. Most FSPs seem to have very rudimentary systems in place, which often take the form of a simple Excel spreadsheet. According to those stakeholders who are aware of complying with current legislation, the effort to update and maintain this data seems to be disproportionate. One FSP mentioned that one experienced resource spends about 90% of their time on tracking training of 3000 representatives. This disproportionate amount of time has led many FSPs to consider partnering with professional bodies in future to ensure compliance with the proposed legislation. In addition, stakeholders mentioned that systems that are more sophisticated would be required to collect and search through data.

Professional bodies such as the IISA and the FPI have systems in place that currently track CPD.

According to interviews, these professional bodies can easily extend and expand their systems to track class of business training and product-specific training for FSPs, KIs and representatives. This will be at an additional cost to recover the basic administrational burden taken up by the professional bodies that are non-profit organisations. Using the IT systems of these institutions would be a suitable solution for industry players that do not have the necessary systems in place to comply with the proposed recordkeeping criteria. Both the FPI and IISA have confirmed that their systems have the capacity to track high additional volumes.

Accredited trainers are also required to keep records of the training. While this is not required in the Draft revised fit and proper requirements (2016), it forms part of their accreditation requirements.[2]

This means that training providers like INTEGRITY ACADEMY will also have to keep a record of all class of business training as part of their accreditation requirements. Accredited trainers might also provide some, but not all, product-specific training and thus records would be kept if this is the case. Since the FAIS Act (2002) does not regulate product suppliers and trainers, the proposed amendments cannot set the requirement that they must track product-specific training. According to industry opinion, all trainers would not necessarily keep a record of training if it were not a requirement. It is more likely that larger companies will do so, but industry consultation shows that the assumption that it is generally standard practice for everyone to maintain records of training conducted is not the case. [At INTEGRITY ACADEMY we have the capability via our Learning Management System to keep records and we also provide verifiable encoded certificates, which the individual can download after successful completion. This will serve as proof of successful completion.]

Compliance timeline

Since the proposed amendments recognise prior learning, established advisers will not have to meet product knowledge requirements. Particularly, the grandfathering clause[3] states that:

“An FSP, key individual or representative, excluding representatives working under supervision, authorised, approved or appointed prior to 1 January 2015 is deemed to have completed the class of business training

...” and “An FSP, key individual or representative excluding representatives working under supervision, authorised, approved or appointed prior to the commencement of this Notice is deemed to have completed the product-specific training...”[4]

Thus, the class of business training is only applicable to new entrants after 1 January 2015 and persons still working under supervision at this date. In contrast, the product-specific training will only be applicable to new entrants and representatives under supervision at the time of publication of the notice. These individuals will have 12 months from 1 March 2017 (or an additional date is given in section 51/52) to comply with the proposed class of business training.[5]

The compliance timeline is of concern to some industry role-players. One stakeholder was of the concern that the grandfathering clause will lead to two reporting systems that will have to be in place for a few overlapping years. This will be complex unless the legislation treats everyone who is not competent yet as a new entrant. Another industry comment highlights the concern that the implementation timeline is too short: “

The budgeting process for 2017 has been completed and [we] have not budgeted for any development or changes that will follow in 2017 as a result of the amendments. Budgeting for the amendments will commence early 2017 or as soon as the amendments are finalised.”[6]

Specifics

This section gives details on the components of product training i.e. the class of business training and product-specific training.

Class of Business

Class of business training refers to training that focuses on general product category knowledge in relation to the line of business. To assure the quality thereof, the proposed legislation suggests that only an accredited provider[7] or educational institutions[8] can provide the class of business training.

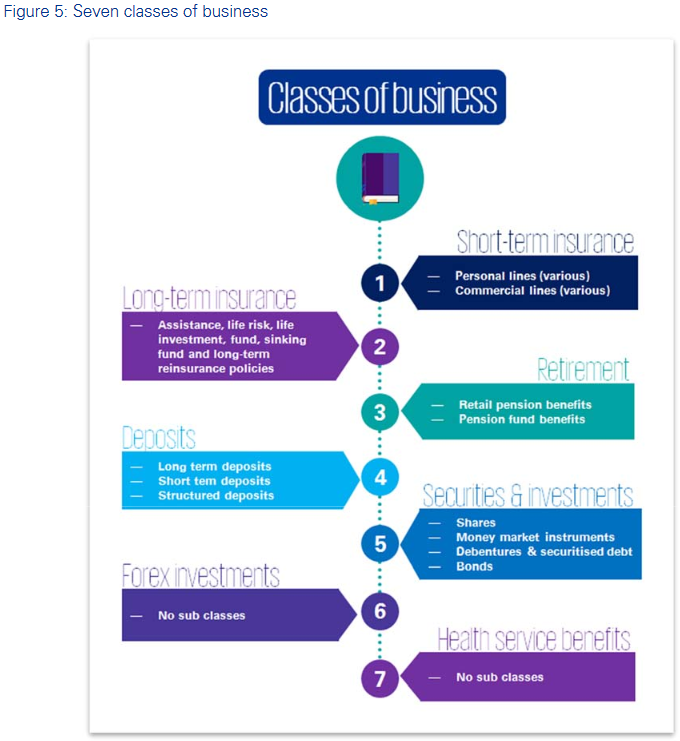

The nine classes of business, as outlined in Figure 5 are each divided into sub-classes under which different financial products fall.

FSPs, KIs and representatives attend the relevant class of business training in which they provide financial advice. Compared to the 26-second level REs, the nine classes of business should reduce the number of hours an advisor spends on meeting this particular product knowledge requirement.

SETAs (two of the industry’s most relevant and prominent being INSETA and BANKSETA) provide accreditation for trainers according to the criteria set determined by the QCTO. This accreditation process can be awarded based on any single or combination of the following delivery methodologies:

Conventional contact classes, recognition of prior learning (RPL), e-learning, distance learning and learnerships. Each methodology is associated with its own learning programme evaluation process.

The accreditation process typically consists of the following phases:

- Provisional accreditation:

The SETA awards this for one year and monitors the training provider.

A verification report must be filled in to ensure continuous compliance.

- Full Accreditation:

The SETA awards this when all the requirements of provisional accreditation have been met (i.e. a successful monitoring visit and a successful verification of learner achievements).

- Re-accreditation:

At the end of the five years of accreditation, providers are required to undergo a monitoring process for the consideration of renewal of their accreditation status through a formalised re-accreditation process.[9]

This process may take up to two years to complete, but the length depends on the complexity of the application and the level of preparation by the applicant. Due to the administrative burden, many industry role-players are of the opinion that an influx of training providers seeking accreditation would not take place if the Draft revised fit and proper requirements (2016) is set in place. FSPs that are not accredited and choose not to do so, will leverage off existing accredited providers to provide the class of business training to KIs and representatives. This will come at an extra cost to both the accreditation provider, the applicant as well as FSPs, KIs and representatives. The accreditation provider will accrue costs of accreditation, such as time to monitor, check compliance of documents, conduct site visits etc. The applicant will incur the costs of getting the necessary documentation in place, compiling a verification report and preparing for the monitoring and verification process. FSPs, KIs and representatives will occur extra costs, as they will have to pay accredited trainers for the class of business training.

At present, FSPs, KIs and representatives attend, and sometimes provide their own selected class of business training although the standards thereof vary considerably, based on interviews. In terms of independent advisors, one stakeholder mentioned that their company offers an external class of business training in four classes (i.e. long term insurance (life and disability), short term insurance (personal and commercial lines), investments and medical aid). In addition, most candidates fall within two of these.

One stakeholder, an FSP that is an accredited trainer, indicated that they will do both classes of business and product training together to save costs. Despite them having systems set up to conduct only class of business training, they will require two years to develop an integrated offering which includes the IT system development, the appointment of an independent assessor and a credible governance forum across their business. In terms of costing, one FSP stated that although the class of business training for short term insurance commercial lines is outsourced, they did incur a once-off fee of R78 400 for personal lines. As an indication, this FSP offers this training to external advisors at a cost of R2 500 to R5 500 dependent on the programme duration and detail.

Because accreditation will not be the likely route for those FSPs currently providing the in-house class of business training, this offering may likely fall away as companies simultaneously strive for cost efficiency and compliance with the new legislation? This remains true despite the fact that the current class of business training by FSPs may well be compliant with the legislation.

When asking stakeholders about the specific requirements of the class of business training as per the Draft revised fit and proper requirements (2016) guidelines, none of the respondents currently included in their training ‘the impact of applicable economic and environmental factors such as inflation, exchange rates etc.’. Some, but not all stakeholders, addressed:

- ‘investment and risk principles, options and strategies in respect of products in the class of business ‘

- ‘the typical role players or market participants in respect of products in the class of business, including their legal structure‘

- ‘the impact of applicable legislation, including taxation laws, on products in the class of businesses.

Stakeholders seem to have, as part of their current class of business training, all the remaining elements contained in the guidelines. Please note that this discussion related to the specific requirements of the class of business training as per the Draft revised fit and proper requirements (2016) guidelines refers only to those product suppliers who do currently offer the class of business training, as some do not.

Although a more complete assessment on the capacity of training providers needs to occur, we have completed a high-level initial overview, which shows that there are courses available that could potentially be adapted to fit across all the classes of business. For more details on this, please see Appendix 3.

According to stakeholders, the time to comply with the class of business training (excluding the process of getting accreditation) would vary. This would depend on the material they have that can be re-used and adapted to an accredited class of business training. Stakeholder information indicates that system development could require six to 12 months, while planning and roll-out of the training would require another 12 months. During this phase, an internal governance forum may be useful for collaborating with the learning and development counterparts of FSPs to ensure the appropriate standards are applied. Updating and programming the IT system to capture the new requirements is another cost that will require additional time, money and staff.

With this forecast, a two-year period would be sufficient for implementing these requirements according to stakeholders.

INSETA has plans to develop a class of business training course material in 2019 and provide it free of charge to applicants. This can potentially have a positive effect on the industry if the quality and standard is in line with the FSBs requirements. The SETA providing this material free of charge might lead to competitors providing more in-depth training using new techniques and methods, for an additional charge. Alternatively, classes of business that the free material does not cover, might present additional costs in the industry. While the availability of free material reduces barriers in the industry, trainers may potentially abuse the system by obtaining this free content, and then charge a fee for the training without adjusting the content.

The cost involved in attending training would, according to industry opinion, range between R1 200 and R20 000. This will largely depend on the quality of the training provided, the level of competition between training providers, and the requisite level of depth of the training as well as the standard of the assessment process. This cost will also vary between different classes of business depending on the complexity of each. For example, the R20 000 refers to training that would be permissible and forms part of a recognised undergraduate course. However, interviews have shown that despite guidelines within the Draft revised fit and proper requirements (2016), stakeholders remain unsure of the exact requirements and hence the required level of compliance. This may be because of the many amendments and revisions to the draft legislation or the inclination of some industry players to wait for the finalisation of the legislation before engaging more fully with the requirements.

The requirements for an accredited class of business training state that the training should include assessments. The Draft revised fit and proper requirements (2016) require a class of business training to cover the following elements:

Figure 6: Class of business training criteria Source: KPMG, 2017

The FSCA designed product training to combine product-specific aspects with certain legislative requirements. According to stakeholders, this is positive as the requirements (such as tax consequences) in Section 7 of the General Code of Conduct can be integrated into the class of business training criteria. This will lead to a more coordinated and competent financial services sector where FSPs, KIs and representatives will be able to understand products themselves and the related legislation. Under the current requirements, the first-level REs focus on legislation and the second level REs on product knowledge. In the proposed product training this knowledge can be combined.

{article Intro-Class-of-business}{text}{/article}

Product-specific training

Product-specific training will focus on the particulars of the individual products offered by-product a supplier i.e. features, risks, benefits and characteristics. There is, however, no requirement that an accredited provider provide product-specific training.[10]

According to stakeholder opinion, product suppliers would be most suitable to provide product-specific training, being the product experts. Due to different understanding and different business structures across the industry relating to the proposed standards and processes of product-specific training, the estimated costs vary widely. Although all FSPs currently conduct product-specific training in some form, costs that stakeholders communicated relate to training on new products or updates on existing products. In addition, several FSPs also referred to the revision of existing training to ensure that the suitable level of compliance was achieved. Currently, all FSPs, KIs and representatives receive some form of product training, as they are required by the FAIS Act (2002) to have knowledge of the products they are selling. The proposed legislation looks to formalise this training and adds certain guidelines, to ensure that FSPs are suitably competent in the products being sold.

Product training seems to be conducted by FSPs, which they offer to both internal employees as well as external employees. Professional bodies do not offer product-specific training but may provide a platform for FSPs to offer this training to a wider audience. One stakeholder offering an online class of business training stated that while they do not plan on providing product-specific training they do see roles in facilitating online portals for hosting such e-courses, tracking product-specific training or providing as an assessor.

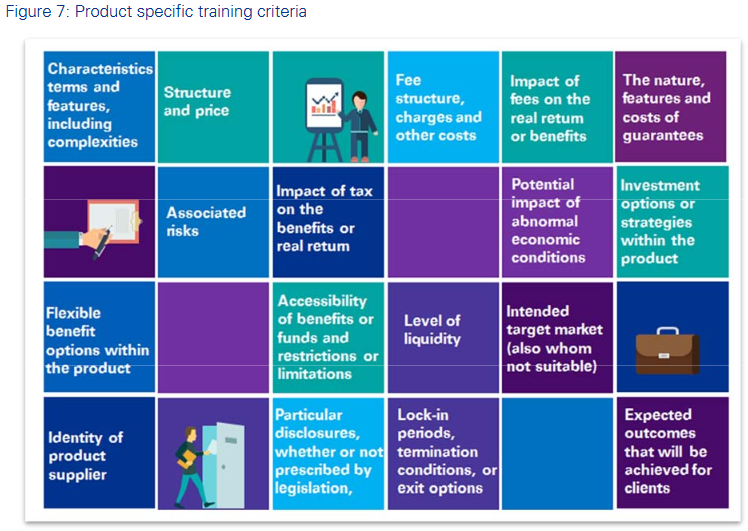

When asking stakeholders about the detailed requirements of product-specific training as per the Draft revised fit and proper requirements (2016) recommendations, none of the respondents currently included in their training:

- ‘the potential impact of abnormal or extreme market, economic or other relevant conditions on the performance of the product’

- ‘any investment options or strategies within the product’

- ‘the level of liquidity of the product or its underlying components’.

Some, but not all stakeholders, currently address the following as part of their product-specific training:

- ‘the impact of tax on the benefits or real return of the product‘

- ‘how the financial product and any underlying components of the product are structured and priced‘

- ‘the fee structure, charges and other costs associated with the product and their impact on the real return or benefits of the product’

- ‘the nature and features of any guarantees and the costs associated with them’

- ‘the identity of the product supplier and the providers of any underlying components of the product, including their good standing and regulatory status’

Stakeholders seem to have, as part of their current product-specific training, all the remaining elements contained in the guidelines.

One stakeholder estimated that product-specific training can cost up to R15 000 per product in terms of developing and conducting the training. Another stakeholder estimated the cost of developing product-specific training to be in the range of R340 per person per day, explaining that it would depend on the complexity of the product and the method of delivering the training. Another stakeholder estimated that R2.2 million would need to be spent to update their current product-specific training to be in line with the new requirements. This is more of a maximum amount and is likely to be relevant for stakeholders who have basic product training in place but do not comply with the majority of guidelines as mentioned in the Draft revised fit and proper requirements (2016).

The FSB licenses independent advisors directly, making it the independent advisor’s responsibility to ensure that they acquire the correct product-specific training, even though they are not directly linked to product suppliers.

Since product-specific training can be provided in combination with the class of business training, some product suppliers who are also accredited training providers plan to do so. One stakeholder commented that the estimated cost of combined training would be between R25 000 and R35 000.

This refers to the cost of training for a single, new agent over two months, which comprises a month of theory and a month of practical training. In the case that the training is provided by different entities, the costs would be higher. This is because both the training provider and FSP are required to keep a record. A large industry role player was of the opinion that product-specific training could range between 2 hours and 2 days (possibly even longer) depending on the complexity of the products.

The proposed legislation states that product-specific training does not count as a CPD activity. CPD only becomes a requirement after the individual has completed class of business and product-specific training, to ensure that the level of knowledge is maintained. According to the Draft revised fit and proper requirements (2016) product-specific training must include training and assessment on the criteria listed in Figure 7. This is relevant for the product itself as well as features of products, underlying components of products and the relevant class of business concerned.

Benefits

Improved levels of consumer protection: One of the largest benefits of continued competence of FSPs, KIs and representatives is consumer protection. In theory, financial advisors who maintain their competence through accredited CPD activities are less likely to omit important information or missell products to their clients. While the cost of this is difficult to determine based on data constraints, information from a KPMG’s annual report on Ombudsman for Long-term insurance may indicate the extent to which this market failure is occurring in the long-term insurance market. In 2016, 30.1% of complaints to the Ombud related to ‘Poor communications/documents or information not supplied / poor service’, while a further 0.2% related to ‘Misselling’. Similarly, a presentation from the FSB notes a trend in complaints being ‘unqualified representative’ and another in regulatory action regarding ‘Lack of competence’.[11]

It is challenging to determine what levels the proposed regulation may work to decrease such complaints, but the assumption is that they will exhibit a downward trend after implementation.

Reduction in the number of substandard class of business trainers/programmes: A benefit that will accompany the fact that an accredited provider must provide the class of business training by is a reduction in the number of substandard trainers. The fact that the accreditation process requires time and resources will be a barrier to entry for training providers that are short-term profit-seeking.

The industry can be confident that the training providers they choose have been through certain quality checks and are monitored, and that they will receive high value for the money and time they invest in training. This eliminates uncertainty in the quality of training provided and protects independent advisors from paying for substandard training. The trainers who go through the accreditation process will present training of a high standard and this will lead to a mort competent financial services industry.

Industry professionalisation: One of the hallmarks of a profession is a high standard of competence by members. The legislating of product training provides a second layer of approval[12], offering the profession more in-depth proficiency and knowledge of their products. This in-depth knowledge increases the reputation of financial advisors, which has its own benefits, including higher salaries and increased use of recognised financial advisors.

[1] FSCA, 2016. Draft revised fit and proper requirements, 2016.

[2] INSETA, 2014. Policy for the accreditation of training providers.

Available: http://www.inseta.org.za/downloads/EPL002_INSQA_Accreditation_Policy_2014.pdf

[3] FSCA, 2016. Section 50 Transitional provisions of Chapter 7 of Draft revised fit and proper requirements (2016)

[4] FSCA, 2016. Draft revised fit and proper requirements, 2016.

[5] Insurance Gateway, 2017. FAIS and the future of second-level REs and CPD – July 2017. Available: http://www.insurancegateway.co.za/ShorttermProfessionals/PressRoom/ViewPress/Irn=15872&URL=Fais+The+future+of+Level+2+REs+and+CPD++July+2017#.WWSR2BFdBYd

[6] FSCA, 2016. Regulatory response to public comments received on the proposed amendments to the determination of the fit and proper requirements for FSPs and representatives.

[7] An accredited provider is a body that is accredited by the relevant SETA in accordance to the criteria determined by QCTO.

[8] An educational institution has the meaning assigned to it in section 1(1) of the NQF Act

[9] INSETA, 2014. Policy for accreditation of training providers.

http://www.inseta.org.za/downloads/EPL002_INSQA_Accreditation_Policy_2014.pdf

[10] 33 FSCA, 2016. Draft revised fit and proper requirements, 2016.

[11] Presentation by FSCA HOD FAIS Compliance Department

[12] The first layer being overall legislation and oversight by the Regulator i.e. the FSCA